Keeping accurate financial records is one of the most important parts of running a successful business. A key part of this process is to record customer payments accurately, helping you maintain a healthy cash flow and clear financial reports. Mistakes or missed entries can lead to headaches down the line—especially when it’s time to reconcile accounts or prepare for tax season.

In this guide, we’ll explain why recording payments accurately is essential and walk you through exactly how to record customer payments in Repairdashboard. Whether your customers pay in cash, by bank transfer, or with a check, you’ll learn how to document every transaction quickly and keep your records organized.

Why Recording Customer Payments Matters

Learning how to record customer payments accurately is essential not only for smooth day-to-day operations but also for maintaining the long-term financial health of your business. When payments are recorded correctly, you can avoid billing confusion, ensure clear cash flow visibility, and build trust with your customers. Properly logged payments offer several key benefits:

- ✅ Simplify tax time by ensuring your records are accurate and complete.

- 📄 Prevent errors and disputes with a clear, traceable transaction history.

- 📊 Track cash flow in real time, making budgeting and business planning easier.

- 🤝 Build trust with customers by offering transparent, professional payment records.

For any repair or retail business, having an organized payment system is the backbone of smooth financial management.

How to Record Customer Payments in Repairdashboard

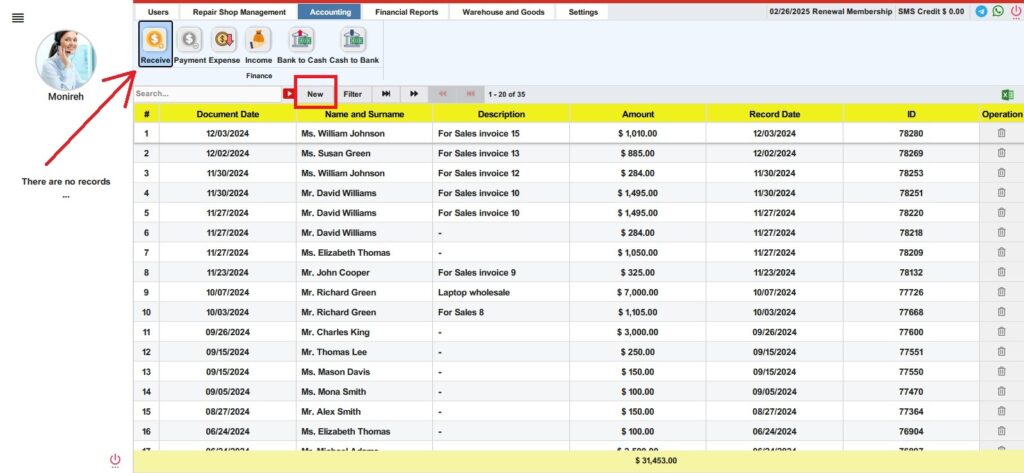

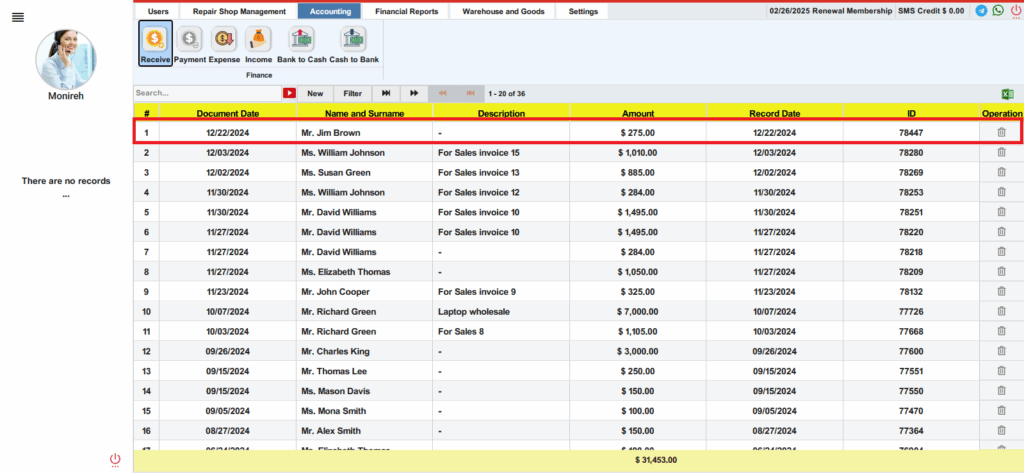

To begin, navigate to the “Accounting” menu and select the “Receive” service to record customer payments. In this section, you can view all incoming payments, including cash, bank transfers, and checks.

Step-by-Step Guide to Record Customer Payments

Start a New Payment Record:

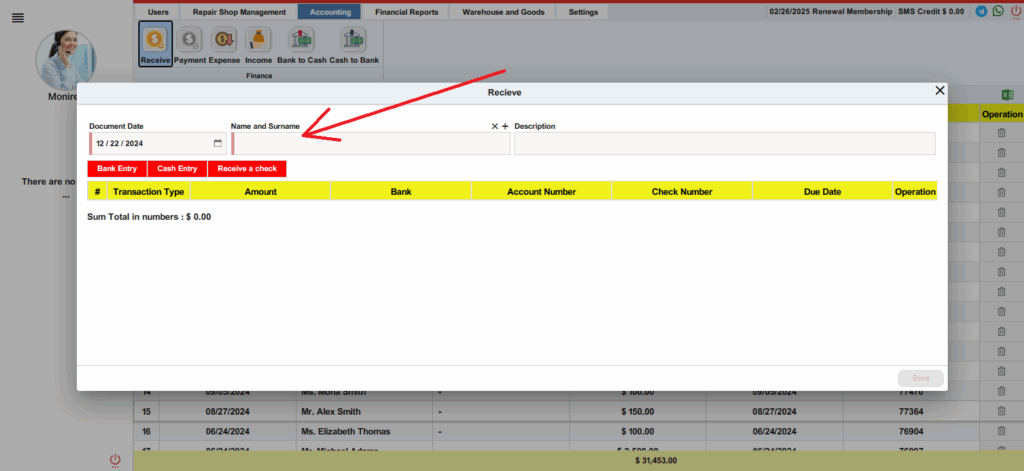

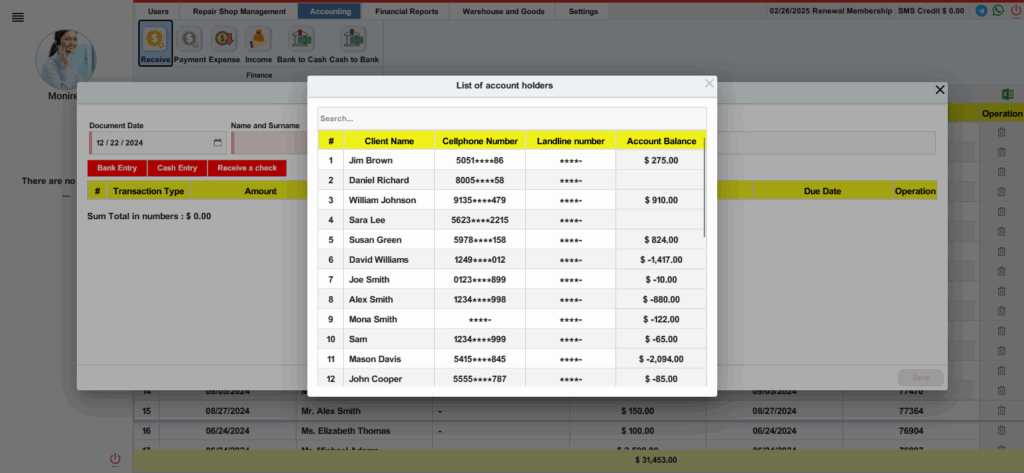

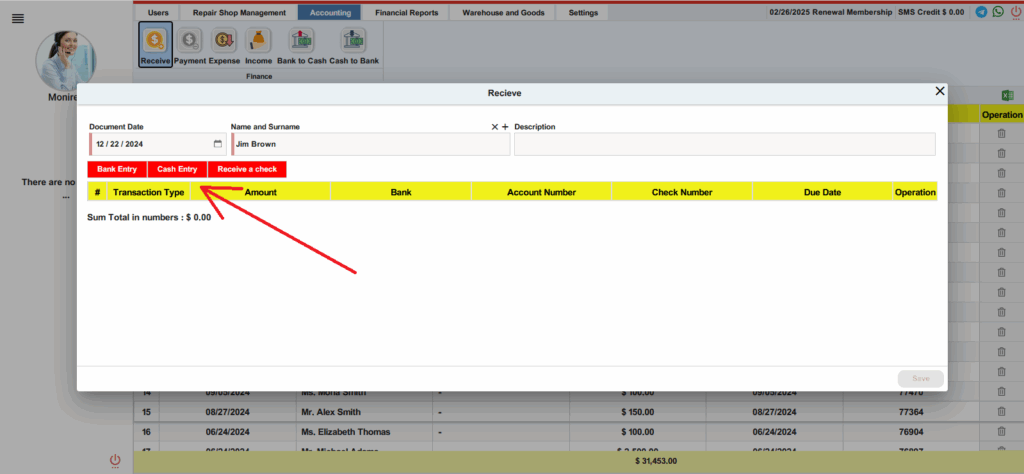

- Click on “New” and select the customer from whom you will receive payment. If you’re just starting out with Repairdashboard and need help adding customers to the system, check out our guide on Easily Add Customers in Repairdashboard.

Verify the Payment Amount:

- You will see the exact amount due. If a negative sign appears before the amount, the customer owes you money.

Add a Payment Note:

- To keep things organized, add a note about the payment in the description field. For example, specify the reason for the payment or include any relevant details, such as linking it to an existing invoice. While this step is optional, we recommend it for better tracking. For more tips on managing invoices and tracking payments effectively, check out our comprehensive guide on How to issue invoices in Repairdashboard.

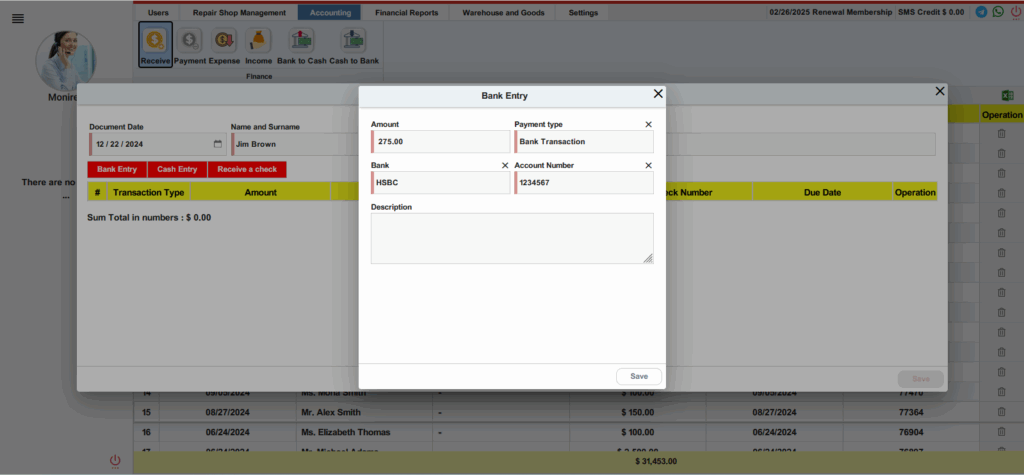

Select Payment Method:

- Choose the payment method—cash, bank transfer, or check—and complete the form.

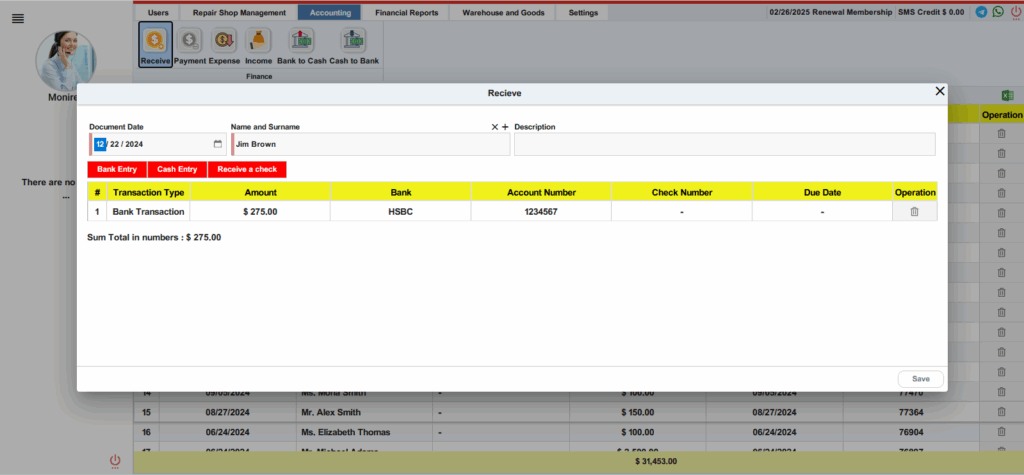

Save the Record:

- Finally, click the “Save” button to record the payment.

Where Are Payments Recorded?

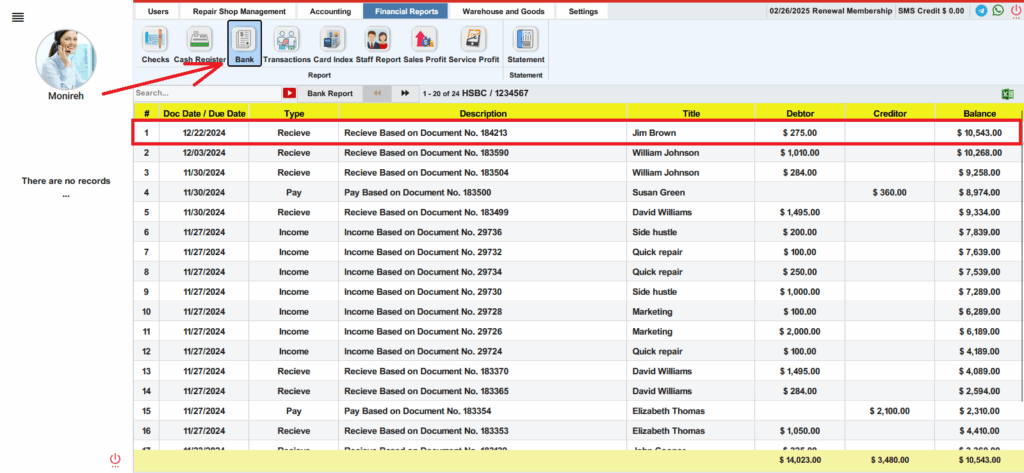

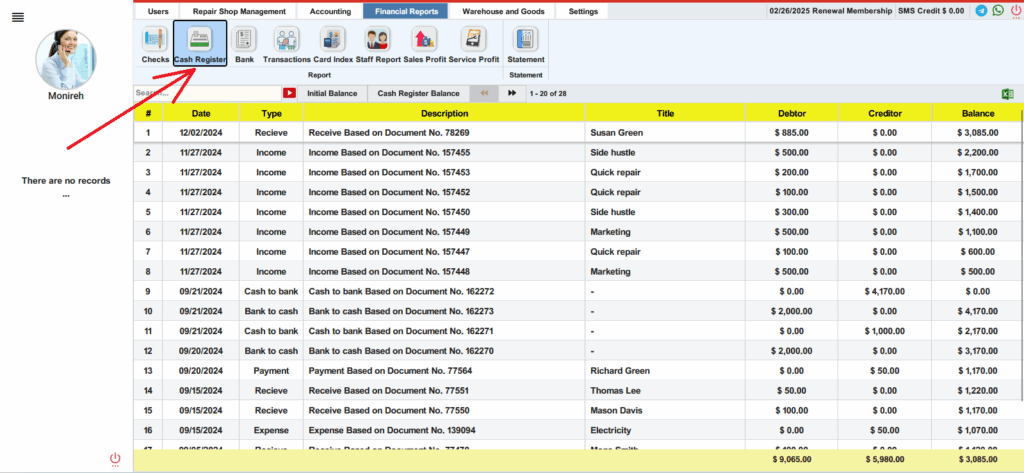

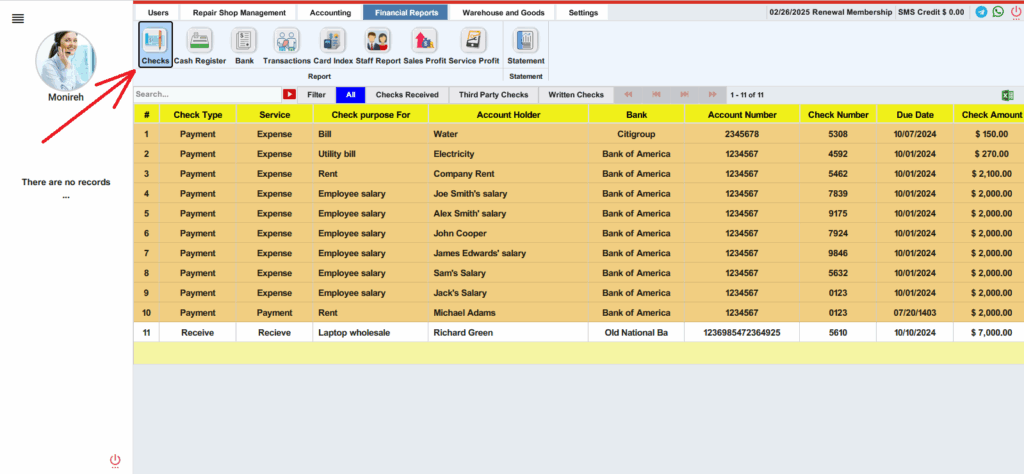

When you receive a payment from a customer—whether it’s by cash, bank transfer, or check—Repairdashboard automatically records it based on the payment method. Each payment type is directed to a specific section within the Financial Reports menu, helping you maintain clear and organized financial records.

This categorization not only keeps your transactions easy to track, but also simplifies your accounting and reporting. Let’s take a look at where each payment type gets recorded:

- Bank Transfers: These are saved under the “Bank” section in the Financial Reports menu.

- Cash Payments: Logged in the “Cash Register” section for real-time cash flow monitoring.

- Check Payments: Stored in the “Checks” section for easy follow-up and clearance tracking.

By categorizing payments this way, Repairdashboard allows you to filter, search, and manage your finances more efficiently—ensuring no detail gets lost.

Troubleshooting: What If Something Doesn’t Add Up?

Even when you consistently record customer payments, occasional discrepancies can occur—like a mismatch between expected and logged amounts, or an incorrect customer balance. These issues often stem from small errors, such as selecting the wrong payment method or missing a transaction entry.

Fortunately, Repairdashboard gives you the tools to investigate and resolve these issues quickly. Here’s how to troubleshoot when something doesn’t add up:

- Double-check the payment method selected to ensure it’s logged in the correct section.

- Review the customer’s outstanding balance to catch any previous entry errors.

- Use the search and filter tools in the “Receive” service to locate specific transactions and verify their details.

By regularly reviewing how you record customer payments, you’ll maintain cleaner financial records, avoid confusion, and keep your operations running smoothly.

Best Practices for Managing Payment Records

To ensure your financial records stay accurate and organized, it’s important to follow some key habits—especially when you regularly record customer payments in your system.

Here are a few best practices to follow:

- Reconcile your payment records monthly to spot and correct any errors early.

- Add detailed descriptions each time you record customer payments, so there’s no confusion when reviewing transactions later.

- Back up your financial data regularly, particularly if your business handles high volumes of transactions.

- Train your staff to follow the same standardized process when they record customer payments, ensuring consistency and reliability across your team.

With these habits in place, your payment tracking will remain clean, consistent, and ready for audits, reports, or business decisions at any time.

Conclusion

In conclusion, recording customer payments is simple and straightforward with Repairdashboard. By following these easy steps and best practices, you will document every transaction efficiently, save time, and maintain accurate records. Start today and take control of your business finances!

If you want more detailed tutorials, be sure to check out our blog here.