Tax Management Made Simple

Keep your invoices professional, accurate, and tax-compliant — no matter where you operate.

RepairDashboard’s flexible tax engine makes it easy to apply local tax rules, automate calculations, and stay audit-ready without extra paperwork. Whether you run a repair shop, a retail store, or both, managing taxes is effortless and fully customizable. You can define multiple tax types, assign them per item or service, and let the system handle the rest — giving you more time to focus on growing your business.

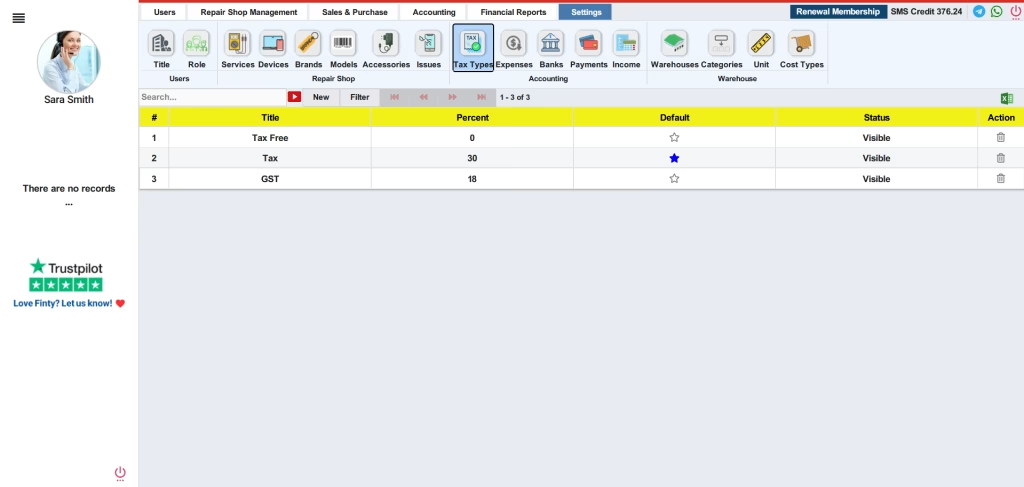

Flexible Tax Setup

RepairDashboard lets you define multiple tax types with custom names and rates — from standard sales taxes to service-specific rates.

You can create any structure that fits your country’s regulations and business model.

This flexibility helps you stay compliant while customizing invoices for any repair or sale.

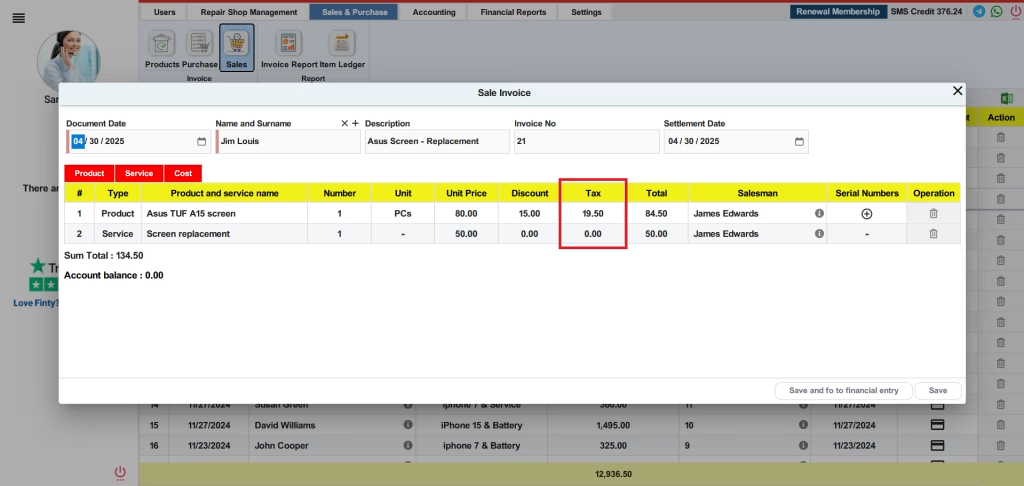

Per-Item Tax Application

Not all services or products are taxed equally — and that’s where per-item tax logic shines.

You can apply tax to individual services or products, leave others tax-free, or mix both on a single invoice.

It’s perfect for shops with diverse offerings or regional tax exemptions.

Automated Tax Calculations: Let the System Handle the Math

Once your tax rules are configured, RepairDashboard applies them automatically to every invoice.

Whether you’re billing for a phone repair or selling accessories, tax amounts are calculated with precision — no manual work required.

It’s faster, more accurate, and ensures every invoice meets regulatory standards.

Seamless Across All Invoices

Whether it’s a sales invoice or a repair invoice, your tax rules are applied consistently.

The system pulls the correct rate for each product or service and updates totals in real time.

This builds trust with your customers and keeps your financial records clean and compliant.

Localized for Global Use

RepairDashboard is designed to support tax environments from the U.S. and Canada to the EU and Middle East.

Define regional tax types, set up exemptions, and generate localized, audit-friendly reports — all from the same dashboard.

No matter where you’re based, you’ll have the tools to operate professionally and confidently.

Can I upload photos and assign repair tickets to technicians?

Yes. You can upload images of the device during check-in to document any visible damage, and also assign each ticket to a specific technician for better tracking and accountability.